Image source: Getty Images

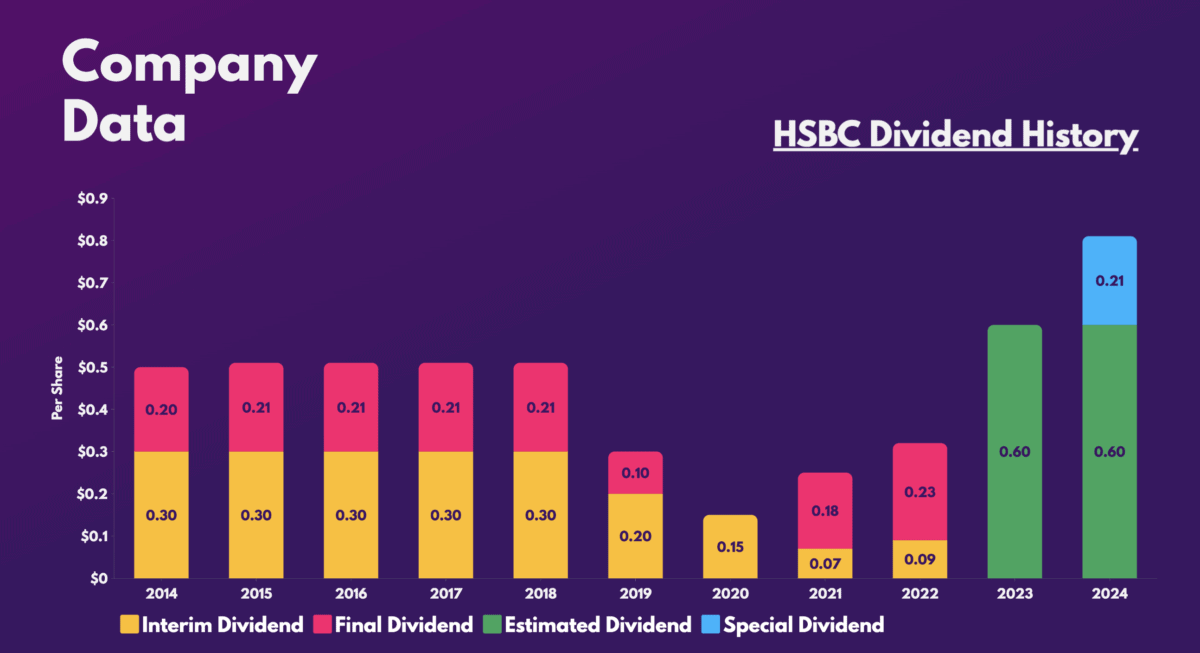

Since October, the HSBC (LSE:HSBA) share price has made a remarkable comeback, rallying 40%. Given its solid set of full-year results, the bank could be set to pay a special dividend, which is certainly enticing for shareholders looking for a second income.

A special treat

HSBC reported its full-year earnings last month. The numbers impressed overall as most of its figures came in above analyst consensus. Consequently, the stock has performed relatively well since the report’s release, with investors excited about the prospect of a special dividend.

| Metrics | 2022 | 2021 | Growth |

|---|---|---|---|

| Net interest income (NII) | $32.61bn | $26.49bn | 23% |

| Net interest margin (NIM) | 1.48% | 1.20% | 0.28% |

| Impairment charges | $3.59bn | -$0.93bn | 486% |

| Net profit | $14.82bn | $12.61bn | 18% |

| Return on tangible equity (ROE) | 9.9% | 8.3% | 1.6% |

The good numbers were a result of high net interest income (NII) and strong international growth. As such, HSBC is opting to pay a final dividend worth $0.23 per share, hence rounding its full-year dividend up to $0.32 per share. But what’s really caught investors’ eyes is the prospect of a special dividend.

The lender is considering paying a special dividend worth $0.21 per share from the proceeds of the sales of its Canadian business. Factoring this into HSBC’s dividend forecast, this would present shareholders with a forward dividend yield of 11% in 2024, which is certainly lucrative as a form of passive income.

Banking on hopes

Despite the potentially rewarding payout though, investors should note that the special dividend is not guaranteed. Shareholders still need to vote on it, and HSBC will have to be in a financially healthy enough position to return capital to shareholders.

It’s worth noting that the FTSE 100 stalwart still has an array of issues to deal with, which could undermine its strong capital and liquidity position. For one, HSBC is still defending itself in several legal cases which include film rights, mis-pricing securities, and anti-terrorism charges. It may have tucked away $409m worth of provisions to cover these charges, but there’s always the risk that penalties could result in heftier charges.

Then there’s the prospect of China’s volatile economic landscape. The world’s second-largest economy is still wrangling with Covid and a property crisis. Both of these could negatively impact loan growth and income for HSBC.

What are HSBC shares worth?

Taking everything into consideration, are HSBC shares worth a buy for its passive income potential? Well, there’s certainly a case to be made when considering its forward yields. At 11%, it definitely piques my interest. What’s more, its current and future valuation multiples are looking fairly attractive.

| Metrics | HSBC | Industry average |

|---|---|---|

| Price-to-book (P/B) ratio | 0.8 | 0.7 |

| Price-to-earnings (P/E) ratio | 9.8 | 10.0 |

| Forward price-to-earnings (FP/E) ratio | 6.2 | 8.6 |

To complement this, the group’s current balance sheet is also relatively strong. With a CET1 ratio (which compares a bank’s capital against its assets) of 14.2%, and liquidity coverage ratio of 132%, it gives the stock a strong base to build from. Thus, it’s no surprise to see Barclays, Citi, and Shore Capital rating HSBC shares a ‘buy’, with an average price target of £7.70. This presents an 25% upside from current levels.

Nonetheless, I’m still not entirely convinced to buy the stock. While its valuation is attractive, there are still plenty of things that could go wrong, especially with its long list of legal wrangles. One or two unfavourable outcomes could result in a huge cut in profits, and possibly at the expense of its dividends too. Therefore, I won’t be investing in the Asian conglomerate today.

Credit: Source link